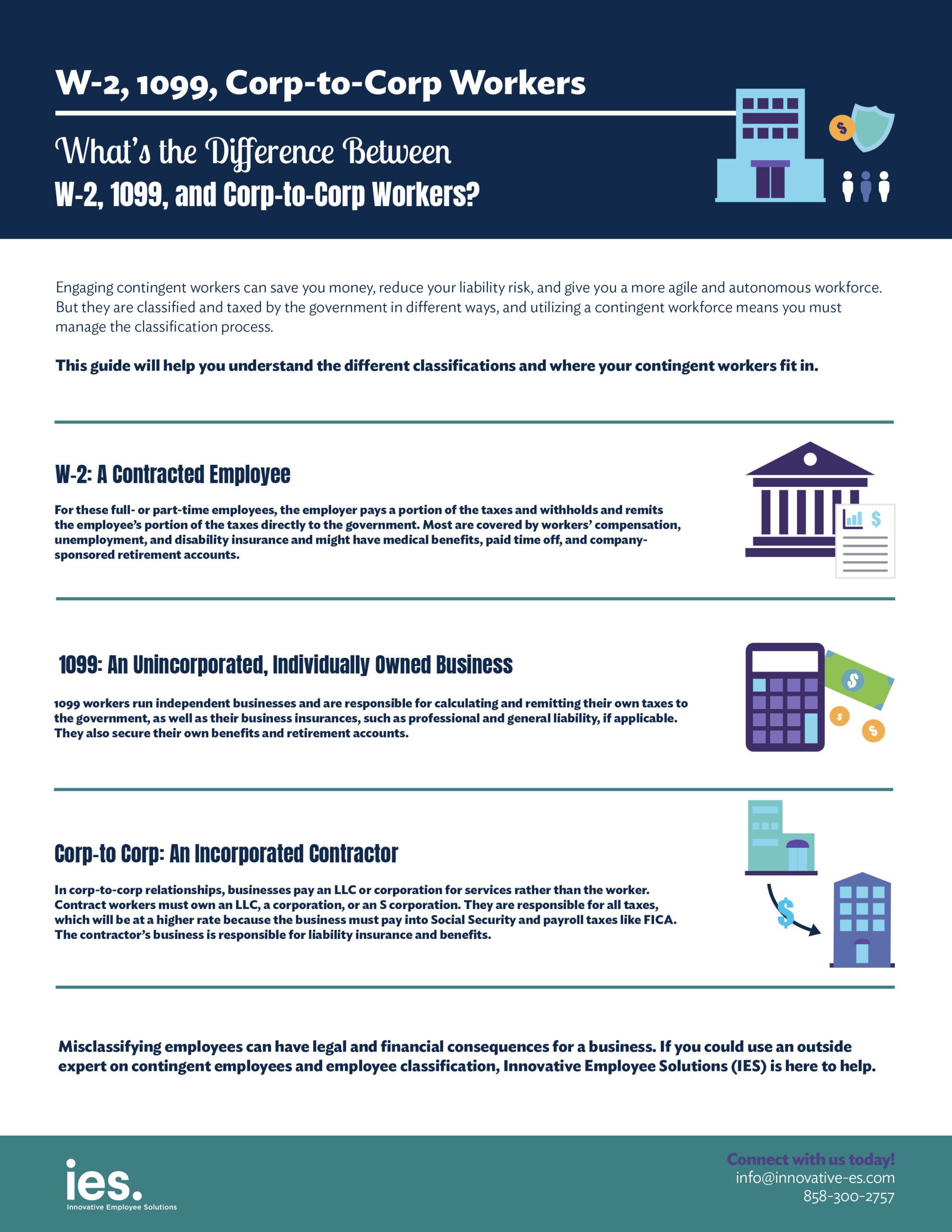

It is a crucial document for tax purposes The 1099NEC is needed to report how much income an independent contractor earns in a yearCONTRACTOR in his/her professional capacity to provide sales &/or marketingrelated services CONTRACTOR shall be an independent contractor and shall be solely responsible for payment of all taxes and/or insurance as required by federal and state law 2 PERIOD OF PERFORMANCE Either party may terminate this agreement upon notice to the otherIndependent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employees In its capacity as an independent contractor, Contractor agrees and represents, and Client agrees, as follows Check all that apply

Sample Independent Contractor Non Compete Agreement Word Pdf

How do you 1099 an independent contractor

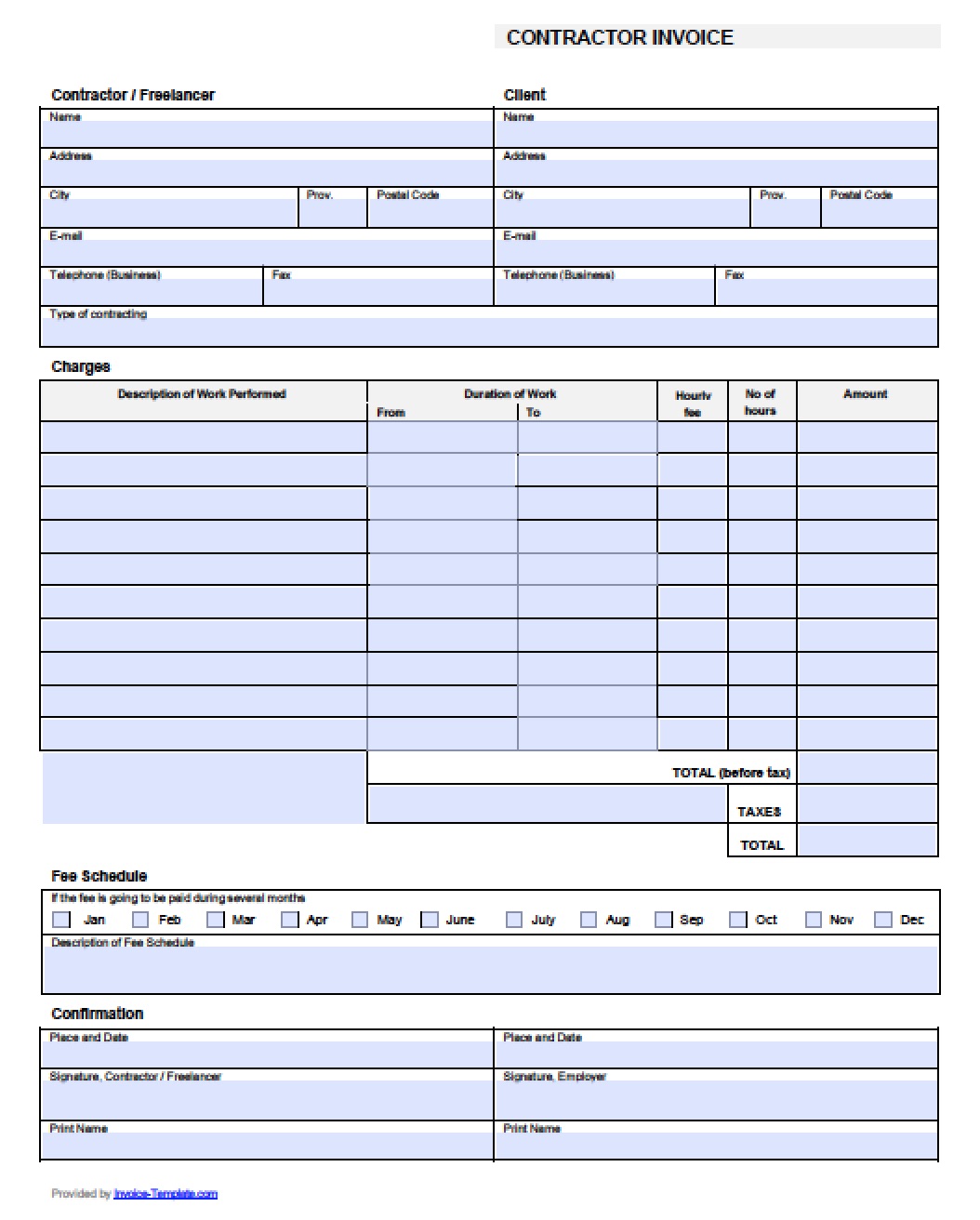

How do you 1099 an independent contractor-Independent Contractor with a tax Form 1099 at the end of each year documenting the amount paid to Independent Contractor The Company will not withhold any taxes, FICA, or other amounts from its payments to Independent Contractor 9 Obligations of Independent Contractor – Independent Contractor acknowledges and agreesIndependent Contractor Agreement DeMarseCo Holdings Inc and Daniel H Smith () Independent Contractor Agreement RedEnvelope Inc and John Roberts () Independent Contractor Agreement Western Brands LLC and Ronald Snyder () Independent Contractor Agreement CytRx Corp and Louis J Ignarro ()

Capclaw Com Wp Content Uploads 13 11 Consulting Agreement Template For 1099 Ee Pdf

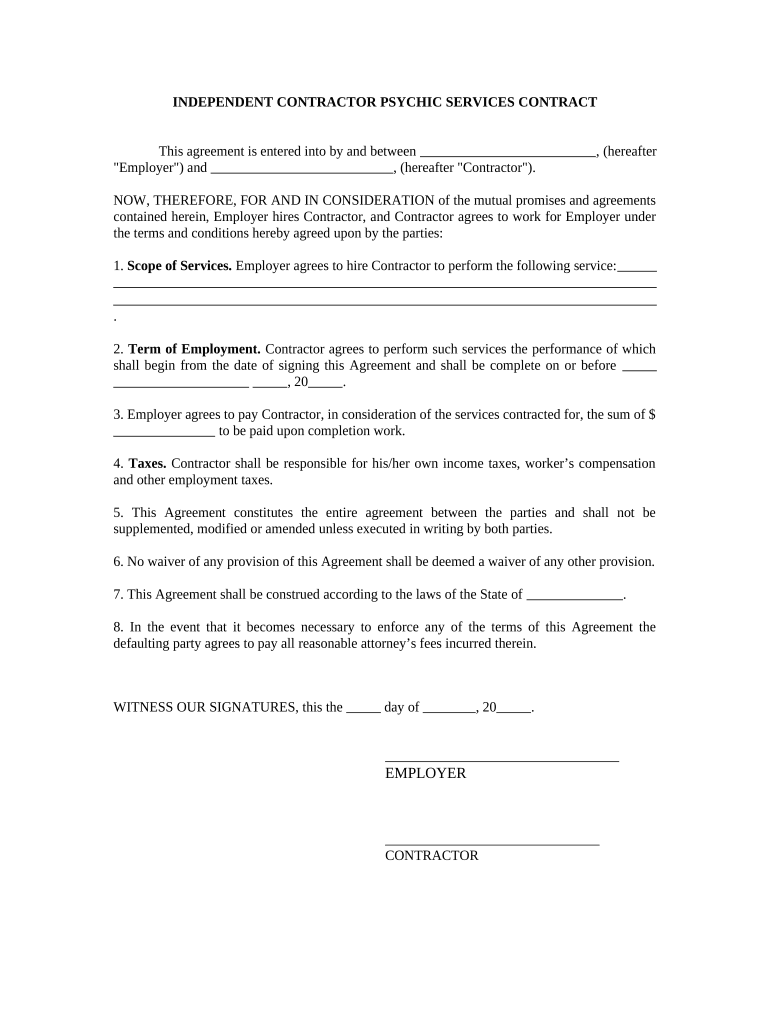

That in performing under the Agreement;It may be terminated by the Corporation with cause – defined as (1) the failure of the Contractor to act in furtherance of the interests of the Corporation and its clients, (2) a material violation by the Contractor of any provision of this Agreement, (3) the conviction of the Contractor of a crime, or (4) an act or omission which in the sole1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Massachusetts Corporation with its principal office at 44 School Street, Boston, MA ("Eastmark"), and independent contractor No employer/employee relationship is created, and neither party is authorized to bind the other in any way Contractor

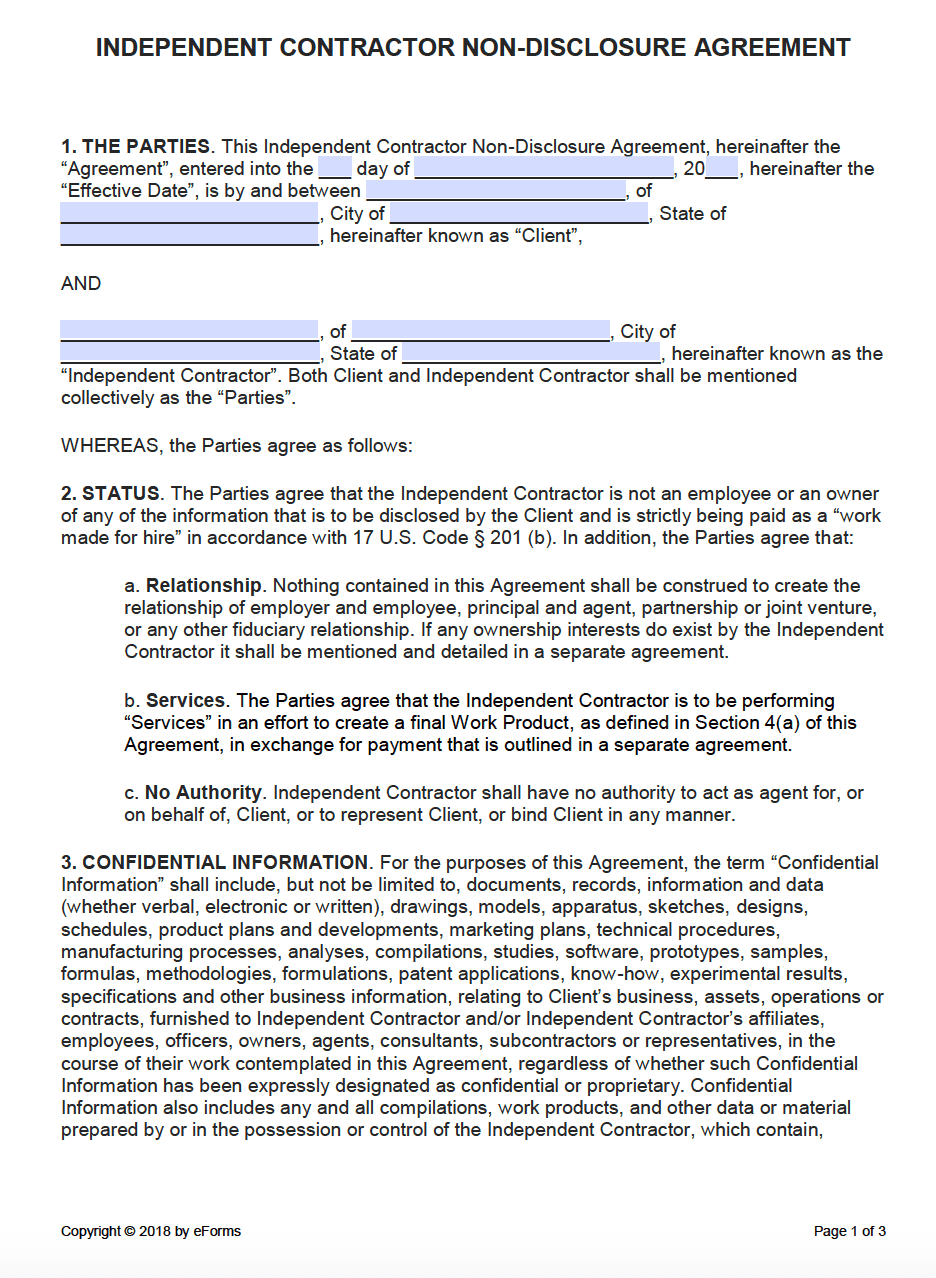

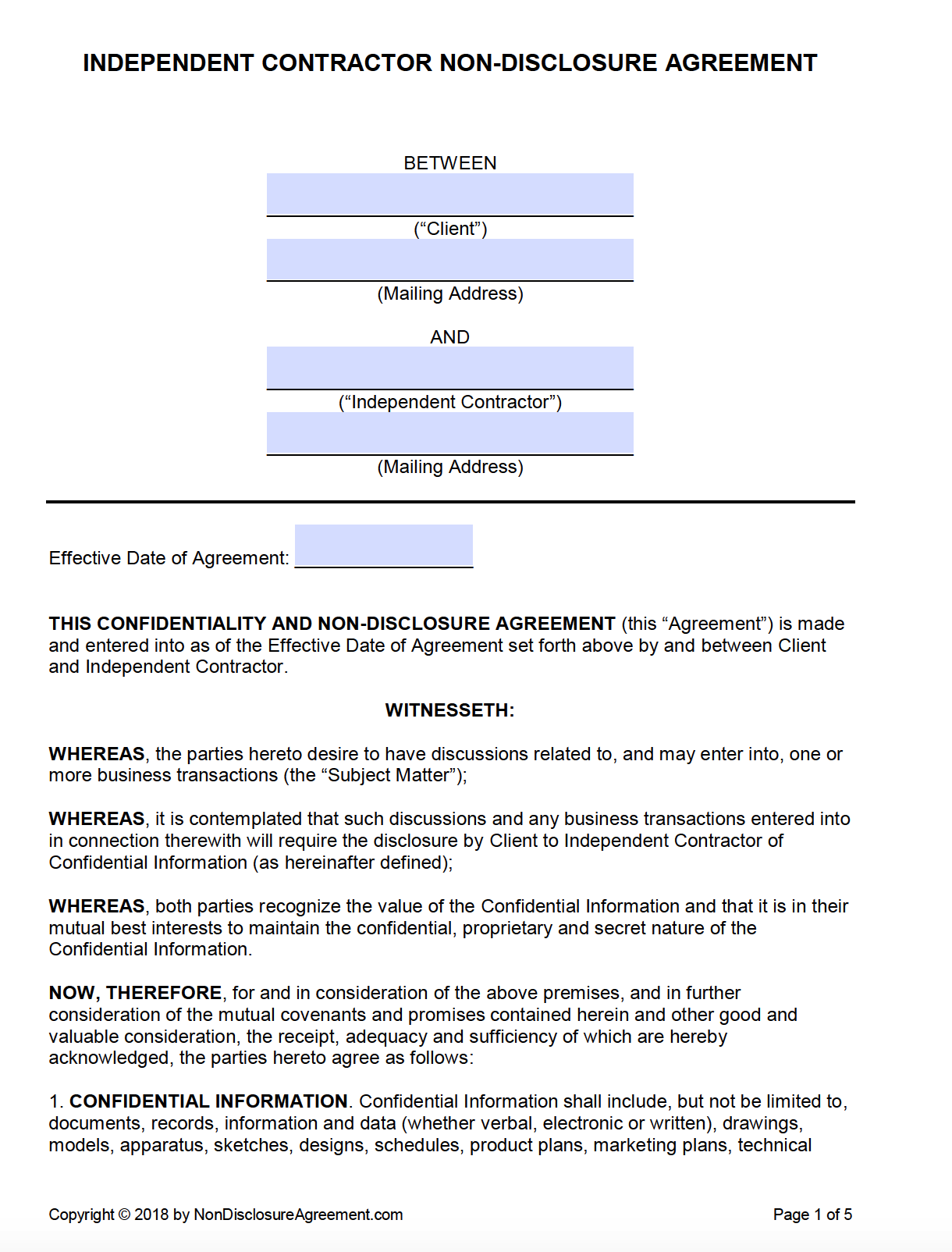

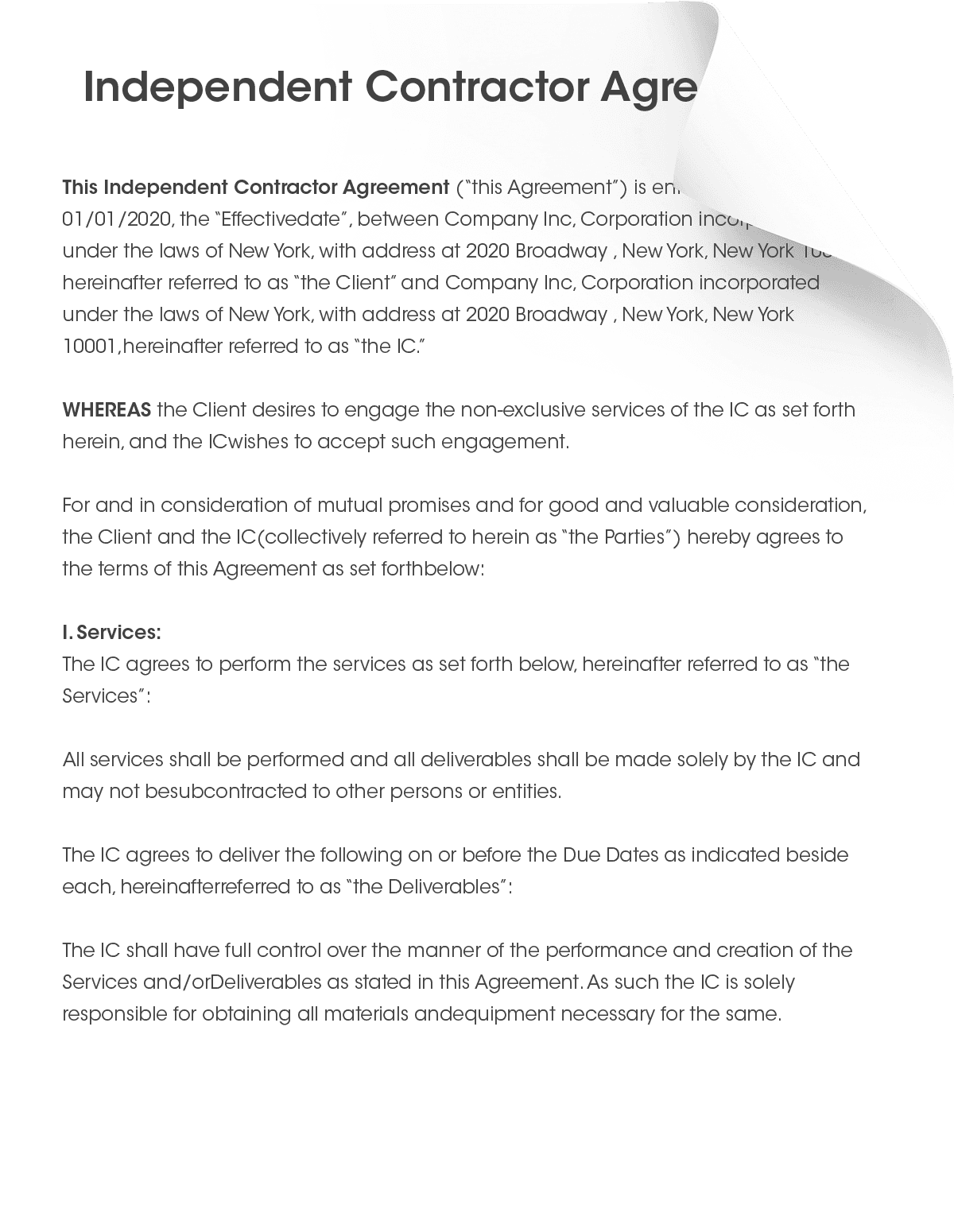

The Contractor hereby represents and warrants to the Company that it is not party to any written or oral agreement with any third party that would restrict its ability to enter into this Agreement or the Confidentiality and Proprietary Information Agreement or to perform the Contractor's obligations hereunder and that the Contractor will notThe independent contractor nondisclosure agreement is intended for use with workers (sometimes known as "1099 contractors" because of their tax status) who perform tasks for you or your business Unlike employees, independent contractors are not bound to maintain secrecy under most state lawsThis Independent Contractor Agreement (this "Agreement" or this "Independent Contractor Agreement"), effective as of date (the "Effective Date"), is made and entered into by and between Client name, a company organized and existing in country, with offices located at address (hereinafter the "Client"), and contractor name, an

_____, the undersigned Independent Contractor ("CONTRACTOR") A DUTIES OF THE INDEPENDENT CONTRACTOR 1 Definition CONTRACTOR is responsible for your own taxes through a 1099 tax form at the end of every filing year; An independent contractor agreement is a contract between a nonemployee worker and an employer for work on an outsourced job or project Independent contractor agreements are also called 1099 agreements, freelance contracts, or subcontractor agreementsA 1099 contractor is a person who works independently rather than for an employer There are significant differences in the legalities of a contractor and employee While the work can be similar in nature, it is important to follow the law with regard to taxes, payments, and the like

Free Professional Marketing Agreement Template For Download

Exh10 1 Htm

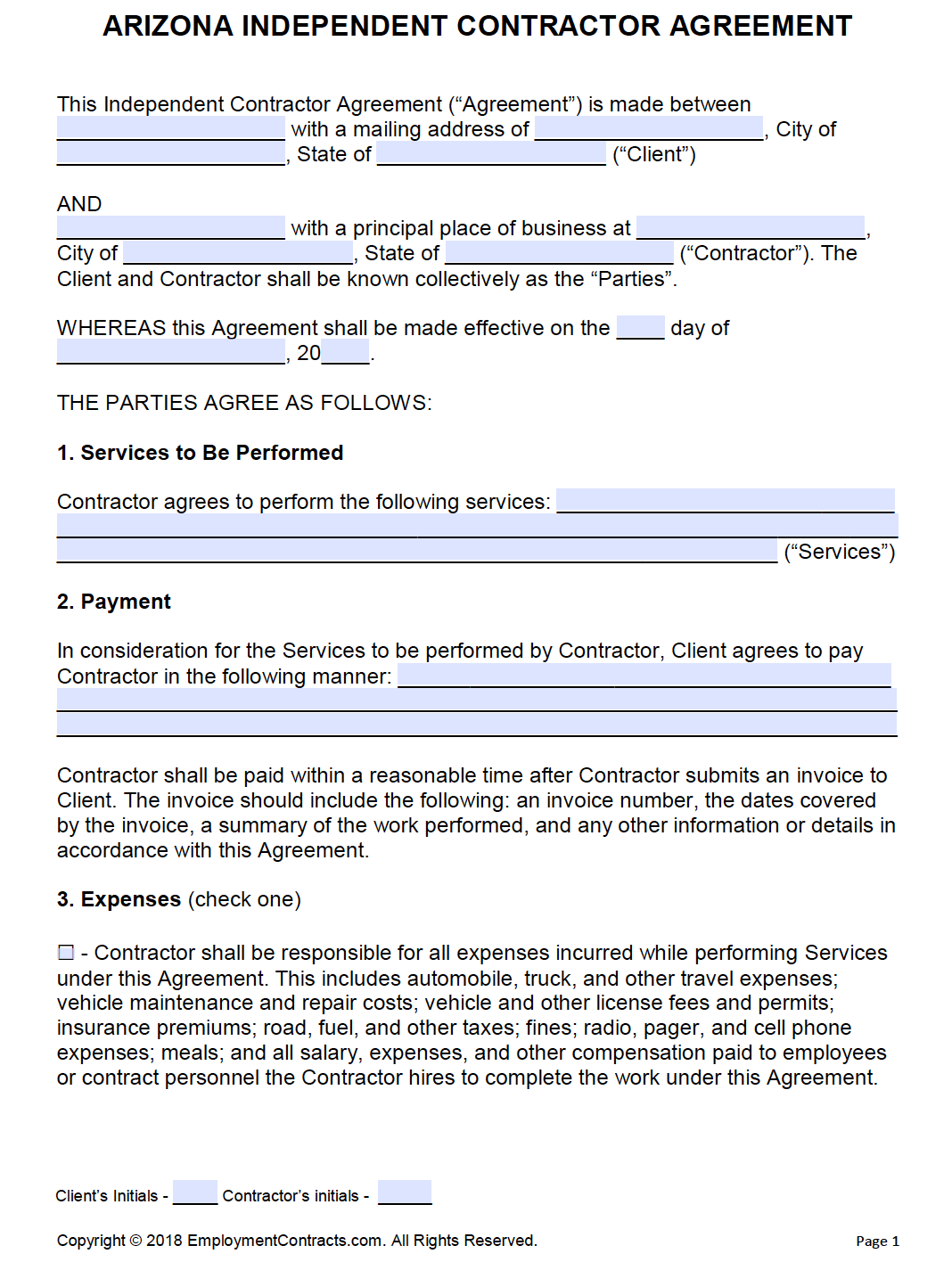

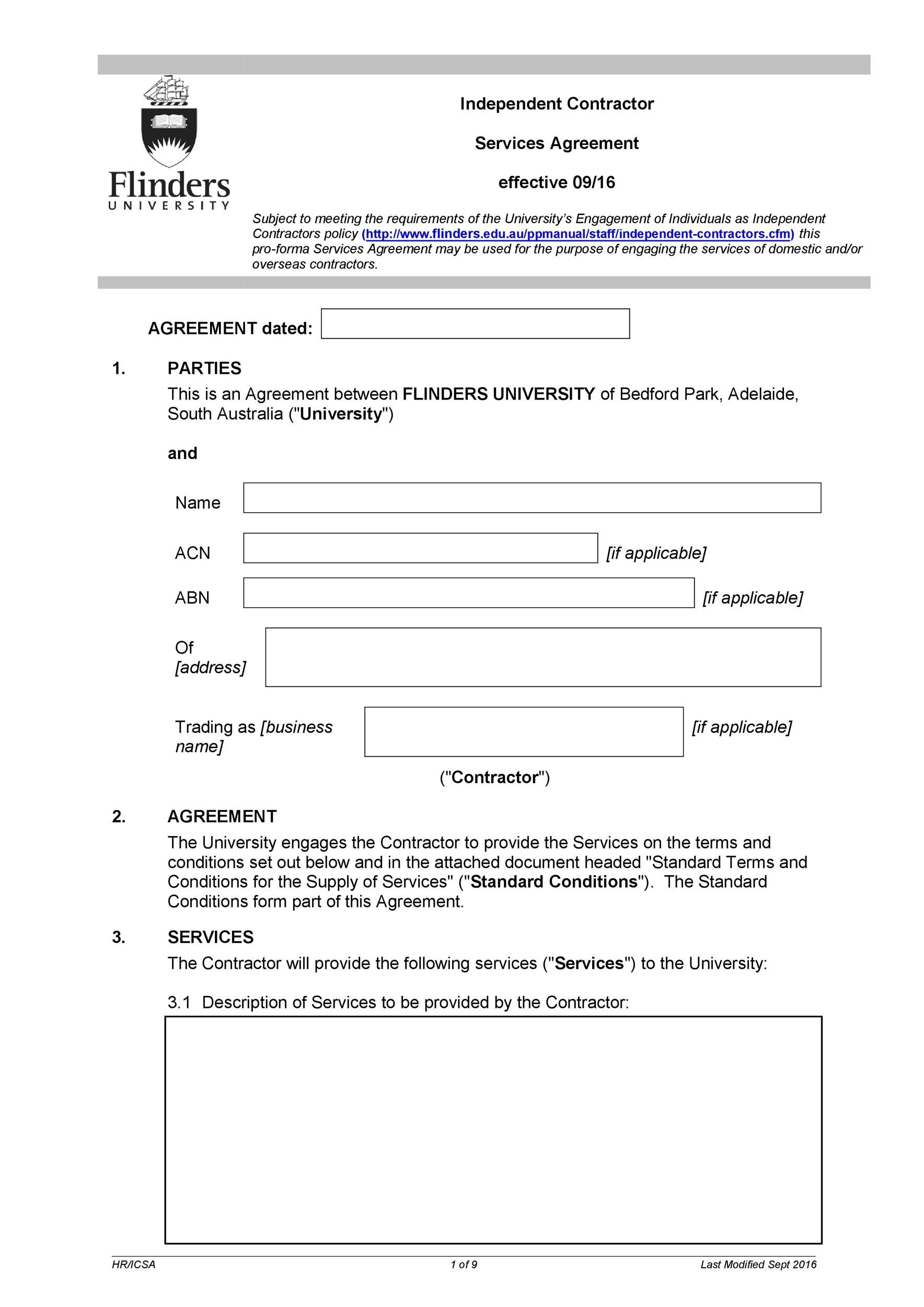

The independent contractor agreement would be needed by anybody looking to hire independent contractors for certain project or just like that for the company operations It could a construction company or an academic institution or a real estate agency and so onAn independent contractor agreement is a document outlining the business relationship between a hiring company and a contractor (or, in cases, a freelancer) It is a legally binding, written agreement that enables both parties involved to cover the base of their working relationship, avoid misunderstandings, and manage expectations This Independent Contractor Agreement (the "Agreement") is made and entered between NAME OF CONTRACTOR, an independent contractor hereafter referred to as "Contractor", and COMPANY NAME, hereafter referred to as "Company" In consideration of the covenants and conditions hereinafter set forth, Company and Contractor agree as follows

Www Laborlawcenter Com Media Wysiwyg Pdf Us bg Pdf

Contractor Invoice Templates Free Download Invoice Simple

Company and Independent contractor agree as follows 1 The Company hereby employs the independent contractor as an independent contractor, and the Independent contractor hereby accepts employment 2 The term of this Agreement shall commence on _____ After the first thirty Independent Contractor Defined People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors However, whether theseIt is understood and agreed that HWS shall provide Contractor with a Form 1099 in accordance with applicable federal, state, and local income tax laws To the extent either Party is required by law to demonstrate compliance with any

Free Florida Independent Contractor Agreement Pdf Word

Free Home Health Care Contract Free To Print Save Download

A truck driver independent contractor agreement is a document that legally binds a contractor and their client to a working arrangement Generally speaking, truck drivers are hired to transport goods from one facility to another or from a seller to a buyer A clear description of the tasks that the contractor is required to fulfill must be provided in the work agreement Furthermore, the An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the startContractor represents and warrants to Company that (a) Contractor has full power and authority to enter into this Agreement including all rights necessary to make the foregoing assignments to Company;

Http Www Columbia Edu Sc32 Documents Ic Study Published Pdf

Instant Form 1099 Generator Create 1099 Easily Form Pros

In providing the Services under this Agreement it is expressly agreed that the Contractor is acting as an independent contractor and not as an employee The Contractor and the Client acknowledge that this Agreement does not create a partnership or joint venture between them, and is exclusively a contract for serviceContracts Agreement Between Pdf An independent contractor What is an independent contractor agreement?In addition to filing their usual personal tax return, independent contractors must file Form 1099 when they provide their annual declaration This is necessary for selfemployed workers as they must pay an additional 15% tax for their Social Security and Medicare needs

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

1099 Form Independent Contractor Free

101 This Agreement supersedes all prior independent contractor agreements of any kind, whether written or oral, between the Parties, preceding the date of this Agreement 102 This Agreement may be amended only by written agreement duly executed by an authorized representative of each party (email is acceptable) 103A business owner needs an Independent Contractor Agreement for several reasons Setting Expectations An Independent Contractor Agreement explicitly sets out the expectations and parameters of the work to be done, the compensation, and the nature of the relationship itselfIt is a clearcut explanation of the expected workflow, how communication will be handled, and how What is a 1099 Contractor?

Fill E Sign To Agreement Between Owner And Contractor Branch With Esignature Signnow

Proof Of Employment Letter For Independent Contractor Payment Proof

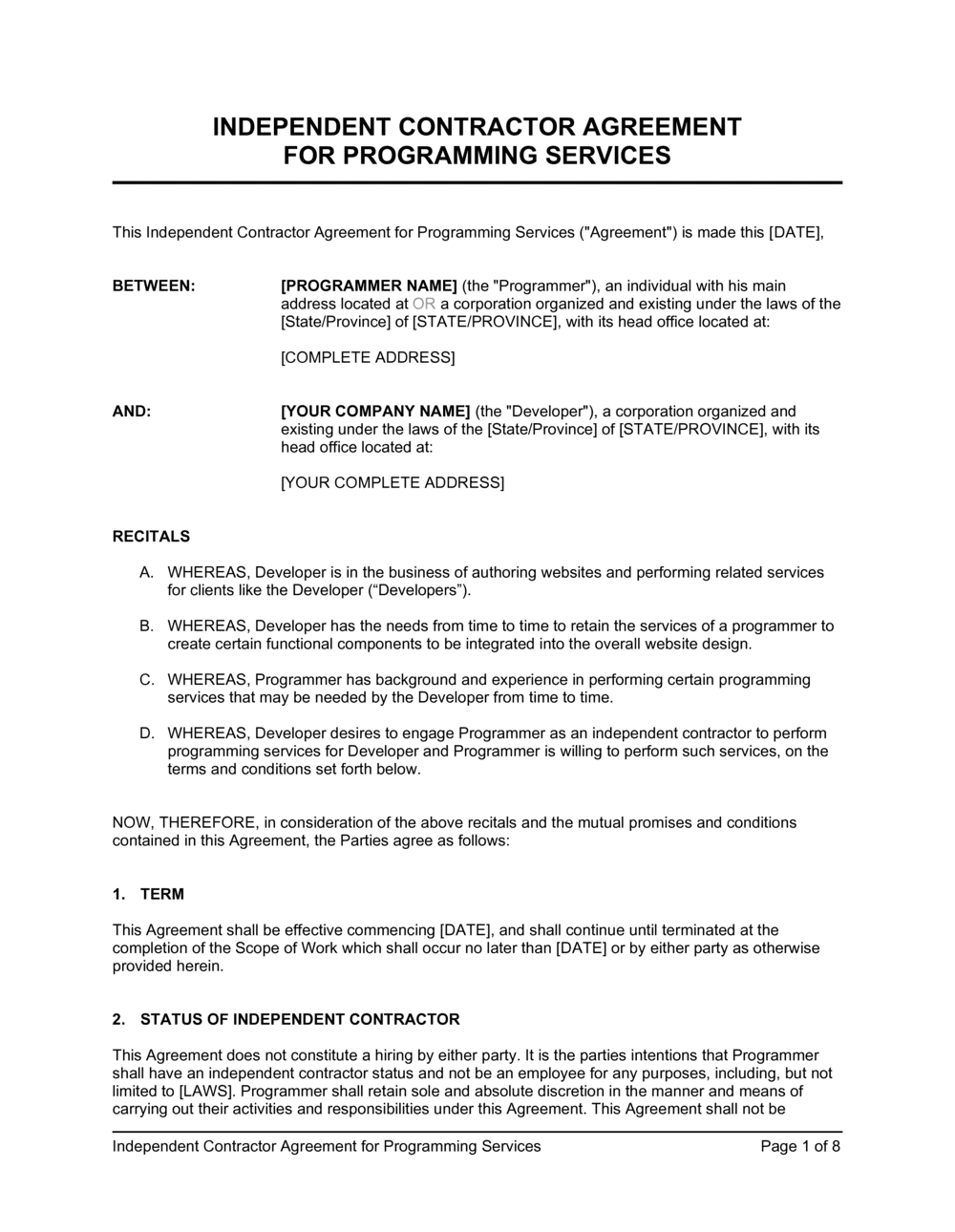

Independent Contractor Agreement INDEPENDENT CONTRACTOR AGREEMENT FOR PROFESSIONAL COUNSELING SERVICES Paraclete Ministry Group, LLC Name of the Agreement Independent Contractor Agreement 1099 which shall be issued in accordance with the Internal Revenue Code and Regulations affecting reporting of payments to independent contractors An independent contractor is considered to be selfemployed, as opposed to an employee They must pay selfemployment tax— for Social Security and Medicare—as well as income taxes, but they must pay this on their own You're not responsible for withholding anything from payments you make to this personC Contractor acknowledges and agrees that the Services shall be provided as an independent contractor As an independent contractor, Contractor acknowledges and agrees that (i) Ministry will not withhold any federal, state, or local income taxes, payroll taxes, or similar taxes from payments to Contractor, and the payment of all such taxes is the sole responsibility of Contractor;

Www Nelp Org Wp Content Uploads Home Care Misclassification Fact Sheet Pdf

Free Independent Contractor Non Disclosure Agreement Nda Template Pdf Word

Independent contractor agreement template Use a independent contractor agreement template when working as an independent contractor for another business Set and clarify the terms of the job, and get paid into our smart new multicurrency business account Download template Open a business accountA simple agreement between a company and an independent contractor, independent contractor agreement is usually used when a company or an individual is hired to a short term task or a specific project Generally, the following things are revealed by a simple independent contractor agreement Who is being hired and by whomThe agreement needs to make it clear that the independent contractor will be a 1099 employee, meaning that the contractor will receive a 1099 form and be responsible for payment of taxes on his or her own The contractor will need to figure these

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

Small Business Tax Preparation For Independent Contractors

A 1099 Contractor is a name given to selfemployed individuals who trigger the need for a company to issue a Form 1099MISC to document earnings paid to this person for services rendered, beyond $599 An independent contractor is a nonemployee of the companyEasy Independent Contractor Agreement Independent contractor agreements are easy to conclude and are a way to clearly outline the scope of work, payment timelines and timelines for a professional agreement Our proposals also contain a confidentiality agreement, insurance expectations and a compensation clauseIndependent Contractor Form Fill Independent Contractor Agreement Employment Independent Contractor Agreement Form Sample Independent Contractor Agreement employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099NEC needs to be completed, and a copy of 1099NEC must be

Http Www Plymouthschoolofmusic Com Uploads 2 6 6 8 Psom15teacherscontract Pdf

Free Subcontractor Agreement Template Pdf Word

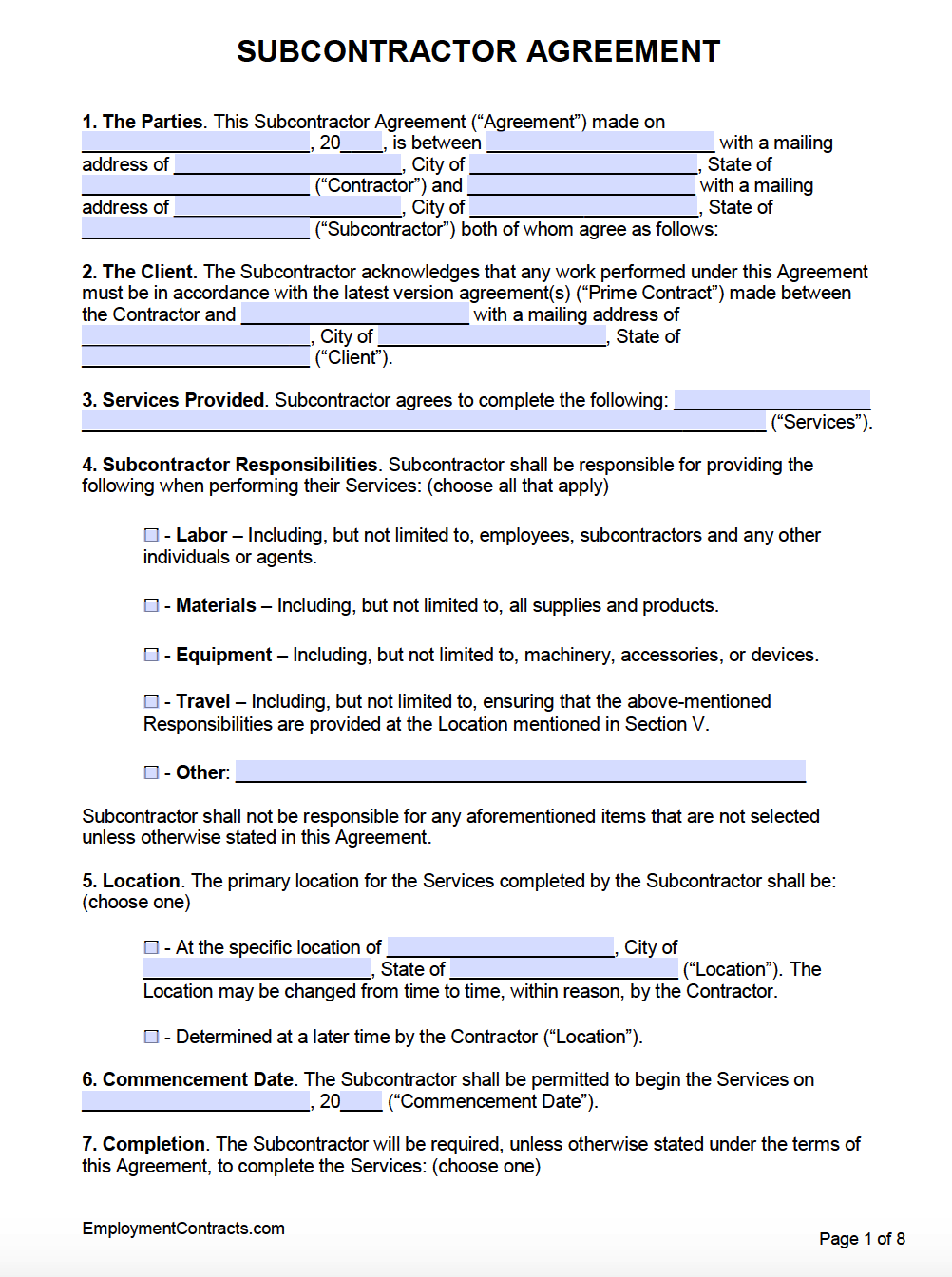

And (c) the Services and any work product thereof are the original work of Contractor,What Is an Independent Contractor Agreement An independent contractor agreement is a contract that documents the terms of a client's arrangement with a contractor This is also referred to as a freelance contract, a general contractor agreement, a subcontractor agreement, and a consulting services agreement, among other alternative namesAn independent contractor agreement is a legally binding, written agreement that details the contractor relationship the business relationship between a payer/hiring company and an independent contractor;

:max_bytes(150000):strip_icc()/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

Hiring Independent Contractors Vs Full Time Employees Pilot Blog

Exhibit 1011 INDEPENDENT CONTRACTOR AGREEMENT This INDEPENDENT CONTRACTOR AGREEMENT (this "Agreement") is made and entered into as of (the "Effective Date"), by and between FVA Ventures, Inc, a California corporation ("ViSalus"), and Dr Michael Seidman ("Contractor")Each of ViSalus and Contractor are sometimes referred to individually(b) Contractor will not violate the terms of any agreement with any third party;As well as your own health benefits, medical expenses, life insurance, and retirement fund CONTRACTOR also acknowledges that CONTRACTOR

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Business Taxuni

This 'DELIVERY DRIVER INDEPENDENT CONTRACTOR AGREEMENT' ("Agreement") is made by and entered into between Company requires such services to be performed exclusively and by the Contractor him/her self 23 The Contractor shall make each delivery in safe and careful manner and complete each deliver within a reasonable amount timeAn independent contractor mayAn Independent Contractor Agreement is a written contract that spells out the terms of the working arrangement between a contractor and client, including A description of the services provided Terms and length of the project or service Payment details (including deposits, retainers, and other billing details)The independent contractor is an individual or a business that is usually selfemployed and provides a service or product in exchange for compensation in the form of monetary payment Therefore, a contractor agreement is a written document that states the terms and working agreement between yourself and the contractor

Employee Or Contractor The Complete List Of Worker Classification Tests By State Wrapbook

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

And Independent Contractor agree as follows 1 Work Status The Employer hereby employs the Independent Contractor as an independent contractor, and the Independent Contractor hereby accepts employment 2 Start Date The term of this Agreement shall commence on _____, ____ Either party may, without cause, terminate this Agreement by giving ____ day(s') written notice to the other 3 Services Provided The Employer shall pay to the Independent Contractor You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting filesContractor shall remain responsible for proper completion of this Agreement 9 Independent Contractor Status Contractor is an independent contractor, not Owner's employee Contractor's employees or subcontractors are not Owner's employees Contractor and Owner agree to the following rights consistent with an independent contractor relationship

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

Independent Contractor Contract Template The Contract Shop

Contractor shall be paid pursuant to IRS Form 1099, and shall have full responsibility for applicable taxes for all compensation paid to Contractor or its Assistants under this Agreement, and for compliance with all applicable labor and employment requirements with respect to Contractor's selfemployment, sole proprietorship or other form ofAgreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employees In its capacity as an independent contractor, Contractor agrees and represents, and Client agrees, as follows (check all that apply) You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1

Independent Contractor Agreement Template Contract The Legal Paige

Free General Contractor Invoice Template Pdf Word Excel

free independent contractor agreement template & what to avoid an independent contractor agreement is a legal document between a business and an independent contractor that outlines the details of the work to be performed terms of the agreement deliverables pensation and any additional clauses free template and instructions provided free independent contractor agreement

When Is Tax Form 1099 Misc Due To Contractors Godaddy Blog

Independent Contractor Application Fill Online Printable Fillable Blank Pdffiller

10 Must Haves In An Independent Contractor Agreement

3

Free Independent Contractor Agreement Templates Word Pdf

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Www Lisd Net Cms Lib Tx Centricity Domain 133 Private lessons teacher independent contractor agreement Pdf

Psychic Services Contract Self Employed Independent Contractor Doc Template Pdffiller

Wrongful Termination For 1099 Independent Contractors Workers Compensation Attorney

Do You Need An Independent Contractor Agreement Includes Free Sample Template Womply

Sample Independent Contractor Non Compete Agreement Word Pdf

3

Free Independent Contractor Agreement Pdf Word

Generalcounsel Fiu Edu Wp Content Uploads Sites 26 14 07 Independent Contractor Agreement For Professional Services Pdf

1099 Form Independent Contractor Agreement Best Of Independent Contractor Agreement Example Simple 16 Independent Models Form Ideas

Blank Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

How To Write An Independent Contractor Agreement Mbo Partners

Freelance Contract Template Free Download Wise

Http Www Hokecounty Net Documentcenter View 449

Employee Versus Independent Contractor The Cpa Journal

/GettyImages-481518099-5c5c983fc9e77c00010a47cc.jpg)

What Is An Independent Contractor

Free Subcontractor Agreement Free To Print Save Download

Wv Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

What S The Difference Between W 2 1099 And Corp To Corp Workers

Nurse Practitioner Employment Contract Template For Primary Care Setting Pdf Free Download

Free Sales Representative Contract Free To Print Save Download

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

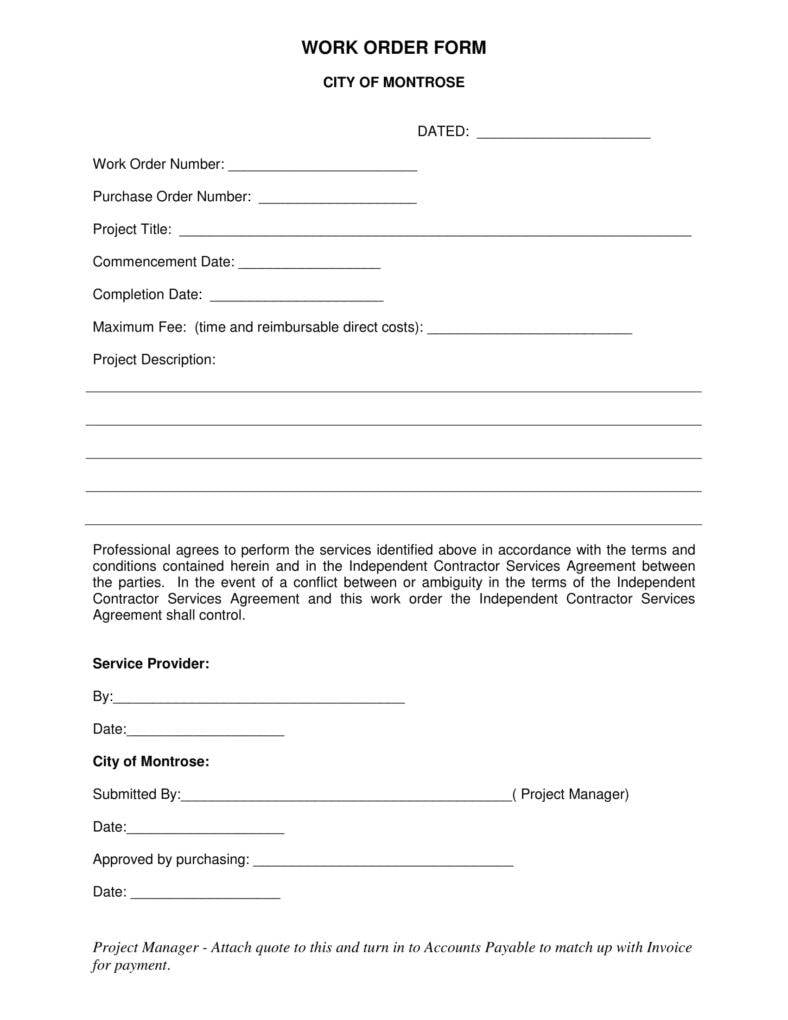

3 Documents You Need When Hiring A Contract Worker

50 Free Independent Contractor Agreement Forms Templates

Newportbeachca Gov Home Showdocument Id

Free Notice Of Contract Termination Free To Print Save Download

Sample Real Estate Independent Contractor Agreement Brilliant 1099 Contractor Agreement Form Models Form Ideas

Http Le Utah Gov Documents Rfp Ethics Attachment1 Pdf

How To Become A Courier Independent Contractor Zippia

Capclaw Com Wp Content Uploads 13 11 Consulting Agreement Template For 1099 Ee Pdf

Truck Driver Contract Agreement Free Printable Documents Contract Agreement Truck Driver Independent Contractor

Http Www Coloradoanesthesiaservices Com Images Fulltime Pdf

Non Disclosure Agreement Nda Template Sample

Download 1099 Forms For Independent Contractors Unique Independent Sales Agent Contract Fresh 1099 Contractor Agreement Models Form Ideas

F R E E C O N T R A C T O R F O R M S T O P R I N T Zonealarm Results

Www Hws Edu Offices Pdf Independent Contractor Agreement2 Pdf

Newportbeachca Gov Home Showdocument Id

Free Arizona Independent Contractor Agreement Pdf Word

Free Independent Contractor Agreement Templates Pdf Word Eforms

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

50 Free Independent Contractor Agreement Forms Templates

:max_bytes(150000):strip_icc()/contracting-papers-92244195-576860795f9b58346a0384c7.jpg)

Hiring And Paying An Independent Contractor

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

1099 Contract Employee Agreement

3

Gkh Com Wp Content Uploads 16 01 Independent Contractor Agreement Sample Pdf

Independent Contractor Agreement Free Contractor Templates 360 Legal Forms

Independent Contractor Agreement For Programming Services Template By Business In A Box

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

Contractor Agreement Form Pros

Free Contractor Invoice Template Independent Contractor Invoice Bonsai

Contract For Construction Work Template Beautiful Contract Employee Agreement Sample Templates Re Contract Template Contract Agreement Templates Printable Free

Independent Contractor Profit And Loss Statement The Spreadsheet Page

50 Free Independent Contractor Agreement Forms Templates

3

Free Independent Contractor Agreement Template Download Wise

Independent Contractor Agreement Pdf Pdf Independent Contractor Registered Mail

50 Free Independent Contractor Agreement Forms Templates

7 Independent Contractor Invoice Templates Pdf Word Free Premium Templates

Independent Contractor Agreement Form California New Independent Contractor Agreement Template 50 New Independent Models Form Ideas

Lsoa School 1099 Agreement

50 Free Independent Contractor Agreement Forms Templates

Http Manoa Hawaii Edu Careercenter Files Independent Contractors Pdf

Newportbeachca Gov Home Showdocument Id

Www Aims Edu Policies Manual Section3 3 300d Pdf

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

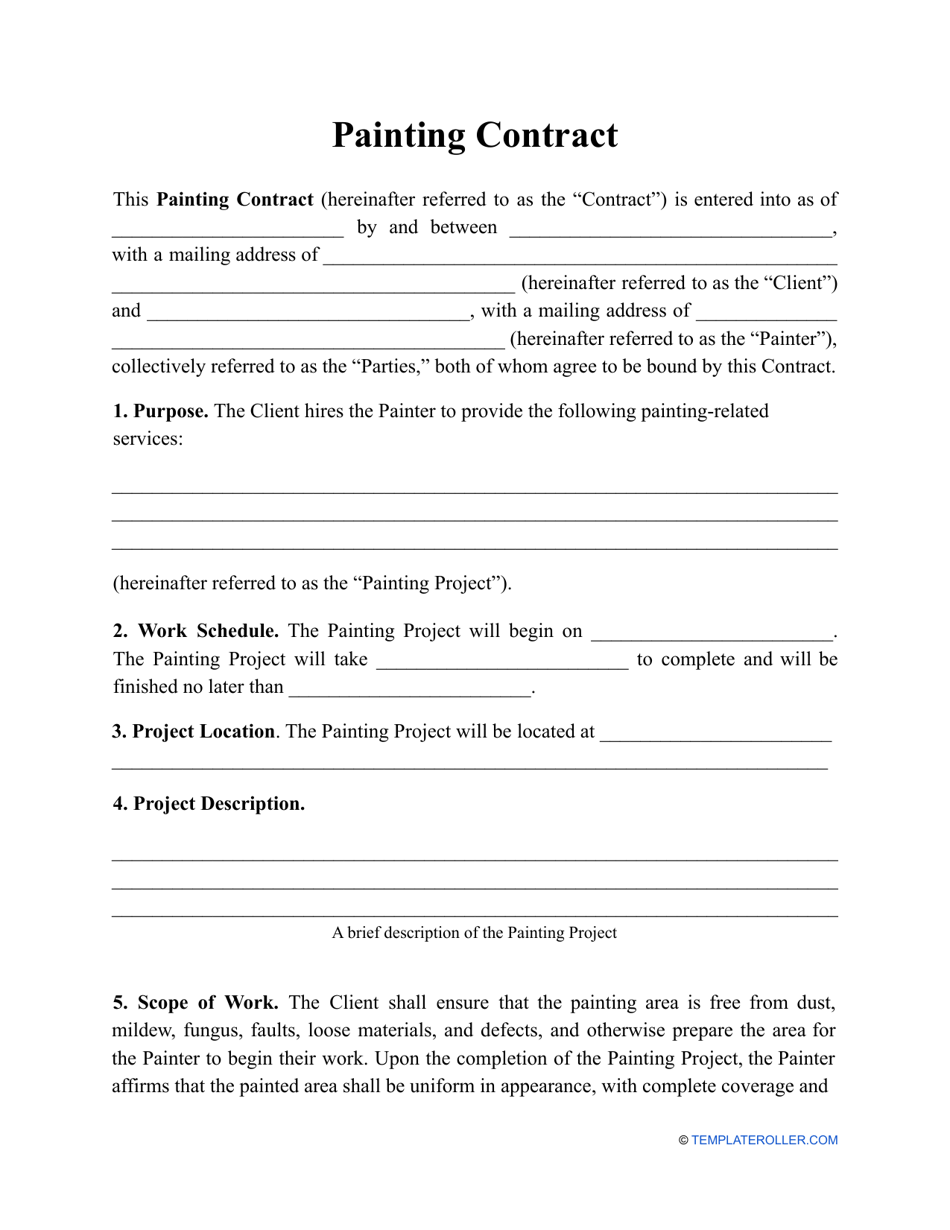

Painting Contract Template Download Printable Pdf Templateroller

Http Floridarockstars Com Wp Content Uploads 13 06 Frs Independent Contractor Agreement Pdf

Www Brotherhoodmutual Com Resources Safety Library Risk Management Forms Independent Contractor Sample Agreement

Fill Out E Sign Contract With Independent Contractorcomputer Consultant Serviceswebsite Design With Esignature Signnow

Gig Economy Improving The Federal Tax System For Gig Economy Work

Free California Independent Contractor Agreement Word Pdf Eforms

0 件のコメント:

コメントを投稿